Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

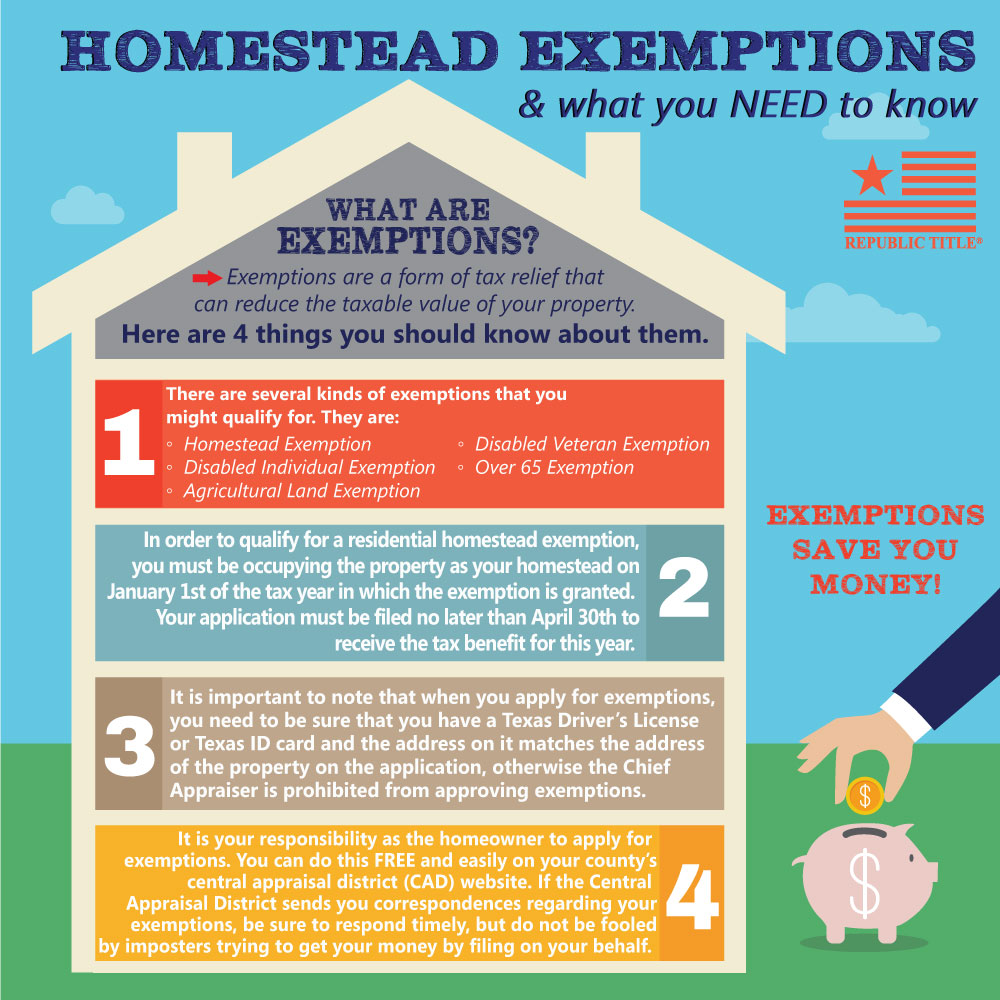

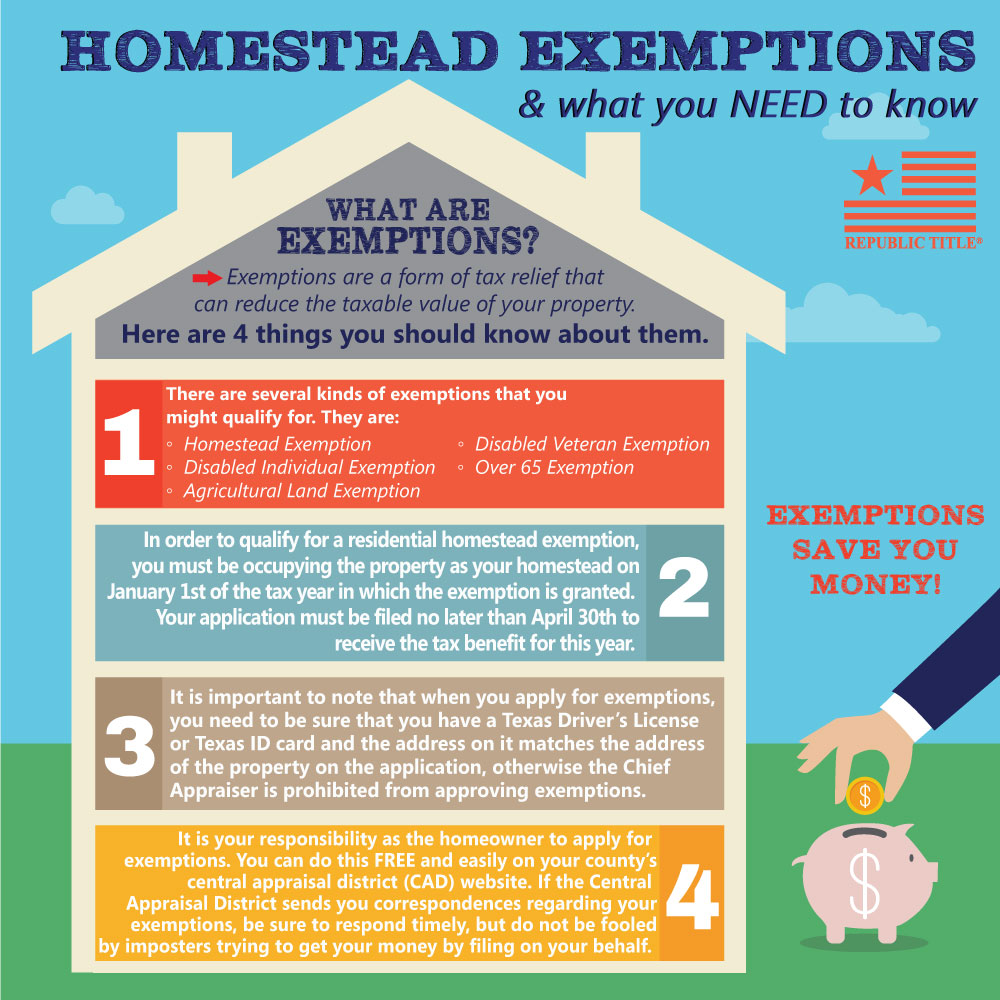

Homestead Exemption

The House You Own And Call Home

The Texas Comptroller website defines homestead as a separate structure, condominium or a manufactured home located on owned or leased land, as long as the individual living in the home owns it. A homestead can include up to 20 acres, if the land is owned by the homeowner and used for a purpose related to the residential use of the homestead. Homestead exemptions can be submitted between the dates of January 1st and April 30th every year.

Many homeowners do not realize that the homestead exemption is free, and the application can be easily filled out. For more information on a homestead exemption in the state of Texas, I highly recommend you visit the comptrollers website. Texas Comptroller

Some homeowners who temporarily move away, can still be eligible for their homestead exemption. Other tax exemptions such as those for individuals over the age of 65 and disabled individuals are available too.

You can also visit the resources page on my website for more information and links. Resources

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link